Reverse mortgage calculator monthly payment

The reverse mortgage calculator will provide. The loan is secured on the borrowers property through a process.

Printable Mortgage Calculator In Microsoft Excel Mortgage Loan Calculator Mortgage Amortization Calculator Refinancing Mortgage

If you are shopping for the best reverse mortgage interest rate be sure to first compare the programs payment options explained in detail below.

. Start by inputting your property type estimated home value ZIP code outstanding mortgage balance if applicable and the youngest co-borrowers age if applicable. Mortgage payment The monthly mortgage payment is calculated based on the inputs you provided. A reverse mortgage can help you pay for living expenses if youre retired and on a fixed income.

Think about the reasons you were considering getting a reverse mortgage in the first place. A mortgage in itself is not a debt it is the lenders security for a debt. Tips to Shave the Mortgage Balance.

You absolutely can lose your home if you have a reverse mortgage. Best Mortgage Lenders Independently researched and ranked mortgage lenders. Hypothec is the corresponding term in civil law jurisdictions albeit with a wider sense as it also covers non-possessory lien.

If you could not make your full scheduled monthly payment on your traditional loan your lender would consider. No personal information is required to calculate your estimate. Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals.

Most mortgages require the home buyer purchase private mortgage insurance PMIlender in case you default. In just 4 simple steps this free mortgage calculator will show you your monthly mortgage payment and produce a complete payment-by-payment mortgage amortization schedule. Thats one extra monthly payment a year.

Youll also need to. The accelerated amount is slightly higher than half of the monthly payment. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

Our reverse mortgage calculator can help you determine how much money you might qualify to receive in a lump-sum payment. Withdrawals were denied beginning in June 2010 when the balance was around 225000 and no withdrawals have been allowed since the servicer has been getting compound interest each. With our advanced mortgage calculator you can.

Change the home price in the mortgage calculator to see how it affects your monthly payment. Mortgage calculator - calculate payments see amortization and compare loans. Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest.

New Monthly Mortgage Payment. You Could Lose Your Home. Typical Reverse Mortgage Closing Costs.

This Reverse Mortgage Calculator will help you understand how much you might qualify for and your options. In addition if you use an accelerated biweekly payment plan you can remove almost 5 years off a 30-year mortgage. Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance.

You can choose to receive a lump sum monthly payments a line of credit or some combination of those options. Unlike a traditional mortgage a reverse mortgage does not require monthly mortgage payments 1. Calculate your monthly payment here.

Once the equity reaches 20 of the loan the lender does not require PMI. Get an Instant Quote by ARLO. I am 87 and received a HECM Loan maximum claim 250000 on June 2006Credit limit due to age and other factors was due to reach maximum claim in 2012.

As a result by the end of the year youll pay an equivalent of 13 monthly payments. Matt and Cindy have two monthly payment options - tenure payments for life or term payments for a specific time period - in their case the ten years in which they expect to occupy the. Term fixed monthly payouts for a set number of years or Tenure fixed monthly payouts as long as you maintain the reverse mortgage and the payout does not cause the balance to exceed the amount stated in the mortgage.

The MoneyGeek Reverse Mortgage Calculator shows how much equity you can get from your home. Compare monthly payments for different home prices. And there are several payment options.

Use our free mortgage calculator to estimate your monthly mortgage payments. Depending on your preference and whats more convenient you can take it as a one-time lump sum fund periodic monthly payments or as a line of credit. So if at all possible save up your 20 down payment to eliminate this.

You can also see the savings from prepaying your mortgage using 3 different methods. Reverse Mortgage Payment Options. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans.

How did we get this number. As rates naturally fluctuate they impact the percentage of your home equity which you can borrowfor example the lower the interest rate the more cash thats available. Enter a few numbers and learn your reverse mortgage options.

If a reverse mortgage lender tells you You wont lose your home theyre not being straight with you. Based on property value and may vary by lender. Account for interest rates and break down payments in an easy to use amortization schedule.

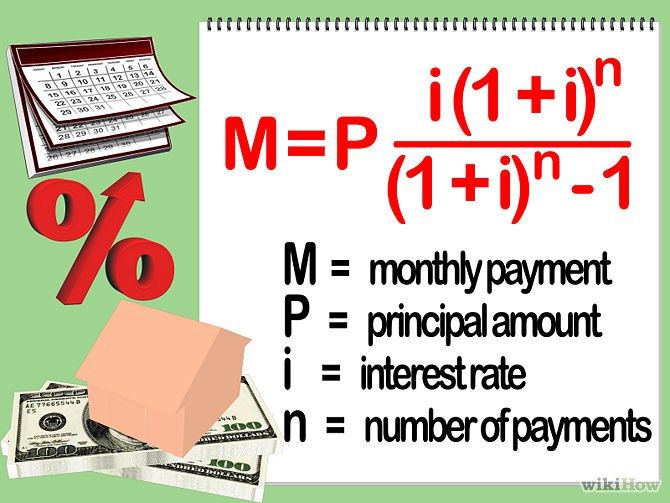

The mortgage amount rate type fixed or variable term amortization period and payment frequency. This calculator will calculate the weekly payment and associated interest costs for a new mortgage. For instance if your.

It does nothing for you except put a hole in your pocket. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Historical Mortgage Rates A collection of day-by-day rates and analysis.

Or if you are already making monthly house payments this weekly payment mortgage calculator will calculate the time and interest savings you might realize if you switched from making 12 monthly payments per year to making the equivalent of 13 or 14 payments per. Many prospects first gravitate to a fixed rate but find the mandatory lump sum unattractive when compared to the flexibility of a line of credit option or monthly payment plans featured on variable interest rate options. Up-front mortgage insurance premium.

See how shortening or lengthening the loan term affects your monthly payment. A general affordability rule as outlined by the Canada Mortgage and Housing Corporation is that your monthly housing costs should not exceed 32 of. When it comes to HECM reverse mortgage payouts borrowers can choose from several options.

The lender actually makes payments to you. A mortgage is a legal instrument of the common law which is used to create a security interest in real property held by a lender as a security for a debt usually a mortgage loan. Your budget is too tight you cant afford your day-to-day bills and.

A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. Mortgage Calculator Found a home you like. A reverse mortgage works in well reverse.

Compare Real-Time Rates Custom Amortization Calculations. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Change the down payment to see how it would impact your monthly payment.

Lower cost than a lump sum payment because youll be paying interest and fees only on the money youve drawn. This number accounts for the largest factors related to reverse mortgage qualification and potential payouts home value location age and any existing mortgage balance.

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Back End Debt To Income Ratio Debt To Income Ratio Debt Ratio Debt

Mortgage Tips And Tricks Reverse Mortgage Information Who Qualifies For R Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Squash Your Monthly Mortgage Payment With A Reverse Mortgage Reversemortgage Reversemortgages Eliminatemortga Mortgage Info Reverse Mortgage Mortgage Loans

Pin On Real Estate Tips News And Market Updates

How Interest Rates Can Impact Your Monthly Housing Payments Mortgage Loans Mortgage Calculator Reverse Mortgage

Image Result For Equity Reverse Mortgage Home Equity Mortgage Amortization Calculator

What Is A Reverse Mortgage A Complex Financial Tool Reverse Mortgage Refinancing Mortgage Refinance Mortgage

Reverse Mortgage 2020 Reverse Mortgage Guide For 2020 And Beyond Reverse Mortgage Mortgage Info Mortgage

How To Create A Mortgage Calculator With Microsoft Excel Mortgage Repayment Calculator Mortgage Calculator Mortgage

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

Remortgage Property Solicitor Reverse Mortgage Mortgage How To Buy Land

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator